Car Finance Broker

Table of ContentsHorizon Finance Group AdelaideHorizon Finance Group Personal Loans

sector associations. However loosen up. It is not as complicated as it seems. If you are exploring a career as a money broker, here is what you require to know. Financing brokers likewise have close connections to constructing cultures, financial institutions, as well as various other loan provider and also can get in touch with them to find you the ideal possible offer. Horizon Finance Group Equipment finance. Money brokers also have specialties, such as trading stocks and also other commodities like minerals and metals. These kinds of money brokers do the job to work out the most effective costs for you. Money brokers take care of a number of financial items, such as insurance and also home loans, supplies and also car as well as personal lendings. Considering that these are their locations of proficiency, monetary brokers commonly have.

minor variations in their jobs from everyday, though generally, several have similar roles. The more typical duties of economic brokers include, however are not restricted to: bring in customers though advertising and also networking; conference customers to discuss their financial products or investment needs; preparing reports on customers'financial circumstances and suggesting ways to boost or preserve their status; encouraging and also supporting customers with economic decision-making with life modifications like marriage, divorce, or retirement; utilizing software, files, or other devices to comb through numerous items to match with their clients 'requirements; speaking with economic institutions or insurance coverage providers concerning their customers 'requirements and wrapping up the very best prepare for all events; organizing the documentation as well as speaking with the appropriate lawful entities till the funding or policy is enacted; and making certain that all insurance policies, fundings, and contracts adhere to existing federal and state legislations as well as guidelines. If you intend to end up being a financing broker, you will require to get a tertiary credentials. You can start this process by completing Year 12 research studies either via attending senior high school or completing an equal course at a various school. You can likewise consider finishing a tertiary preparation certification if you intend to change careers and have not participated in formal education and learning in a variety of years. This step is optional in your pursuit to end up being a finance broker. Famous organizations in Australia consist of the Financial Providers Institute of Australasia, the Home Loan and Finance Association of Australia, as well as Money Brokers Association of. Horizon Finance Group Adelaide.

can compare the products available to provide an option that actually matches the requirements of their client; they basically streamline the mortgage procedure, a complex as well as typically alien process, for their client. They are able to finish much of the paperwork, functioning closely with their customers to look at the required supporting documentation, send the application to the ideal lender, and take care of the process with to settlement. Q. With the bulk of potential buyers mistakenly thinking brokers bill a fee for solution, how are brokers really paid? A. Payments and fees vary from lending institution to loan provider. If you are concerned with the commissions your broker might be earning, ask them upfront they are called for to divulge any kind of payments they might be earning to stay clear of any type of conflict of interest. Q. Exactly how do prospective property buyers find a broker? A. There are lots of ways to discover a broker.

Horizon Finance Group Adelaide

You can meet with a couple of brokers as well as choose the one that finest suits you. The broker you choose need to be a participant of an industry body such as the FBAA. They must likewise be approved under the National Non-mortgage Consumer Debt Defense Act and have a Certificate IV, ideally a Diploma in Financial Services Home Loan Broking. The current study recommends 43%of potential homebuyers are shopping around talking to greater than one broker during the house loan procedure. Why do you believe this could be the instance? A. next page Consumers are trying to find a broker that supplies excellent personalised solution and supplies on their promises. They need to be able to feel they can trust the individual that is mosting likely to assist them with the most significant monetary commitment

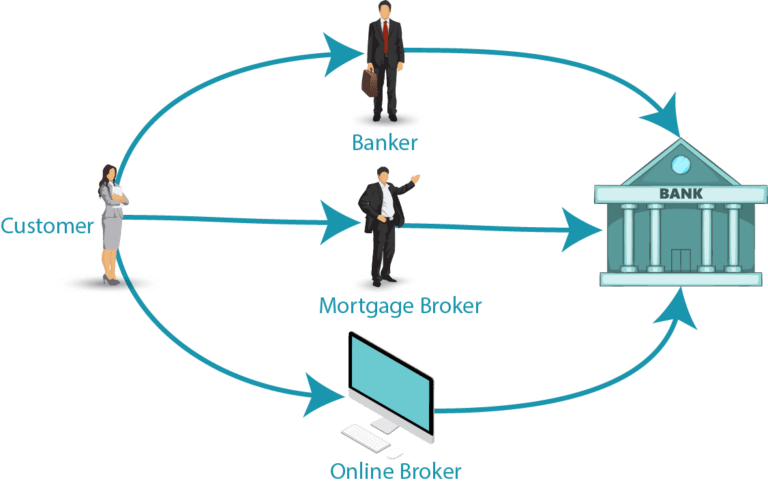

broker agent firm. They will work as a middle male between those seeking a funding as well as the financing suppliers. They'll collect information on your service and with your approval put on bank loan providers on your behalf - Horizon Finance Group. Most importantly an excellent broker will talk to a much bigger number of finance carriers than possibly you would do directly as well as conserve company owner valuable time in relating to numerous loan companies themselves. If you are eager to utilize a bank instead of the numerous professional finance companies that are now found in Australia, after that good brokers ought to have connections with financial institutions as well. A clear broker needs to inform you of the rate of interest rate given by the financing company as well as their markup too. If you're in talks.